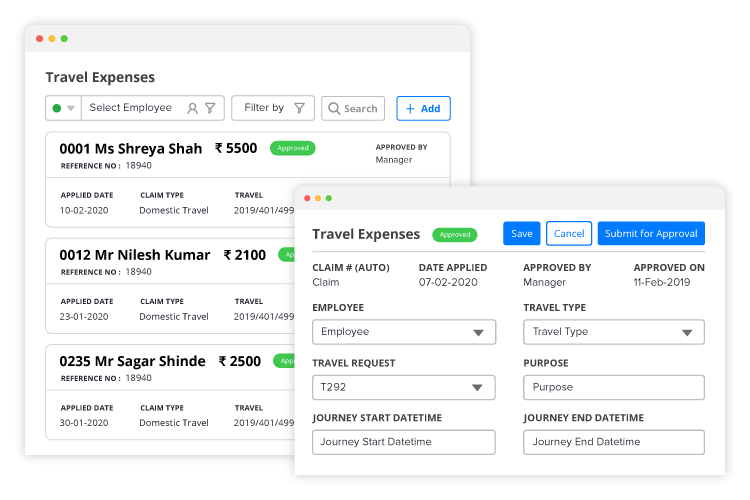

In the present high-speed business environment, overseeing expenses efficiently is essential for expanding profitability and keeping up with monetary health. With numerous exchanges happening every day, keeping track of expenses physically can be time-consuming and prone to errors. This is where the expense management system comes into play. These software arrangements offer businesses a streamlined and automated way to deal with following, dissecting, and controlling expenses.

Enhanced Visibility and Control:

Expense management provides businesses with enhanced visibility into their spending activities. By centralizing all expense information in one place, businesses can easily track and screen expenses in real-time. This visibility permits associations to identify trends, pinpoint areas of overspending, and make informed decisions to control costs. With customizable reporting features, businesses can generate detailed expense reports tailored to their specific needs, giving valuable insights into their monetary performance.

Increased Efficiency and Accuracy:

Manual expenses following processes are time-consuming as well as prone to errors. Expense management automates the expense-following process, eliminating the need for manual information entry and reducing the risk of human error. By integrating with other monetary systems, for example, bookkeeping software and credit card stages, expense management system ensure that expense information is accurately captured and recorded in real-time.

Policy compliance and fraud prevention:

Expense management helps businesses enforce expense policies and procedures, ensuring compliance with internal policies and external regulations. These systems can be configured to enforce spending limits, banner rebellious expenses, and detect potential instances of fraud or misuse. By implementing vigorous endorsement work processes and review trails, businesses can mitigate the risk of fraudulent activities and ensure that expenses are incurred for legitimate business purposes as they were. This protects the association from monetary losses as well as maintaining its reputation and integrity.

Cost Savings and Optimization:

Effective expense management enables businesses to identify cost-saving opportunities and optimize their spending. By dissecting expense information and identifying areas of inefficiency or waste, businesses can implement cost-saving measures, for example, by negotiating better vendor contracts, merging suppliers, or implementing more efficient processes. Also, expense management can help businesses identify opportunities to optimize their travel and entertainment expenses, for example, by booking flights and facilities at lower rates or identifying cheaper alternatives for business-related expenses.

Scalability and Flexibility:

Expense management is designed to scale with businesses as they develop and evolve. Whether a business is a small startup or a large enterprise, these systems offer scalability and flexibility to accommodate changing needs and requirements. With cloud-based arrangements, businesses can access their expense management from anywhere, anytime, and easily scale up or down based on their needs. This scalability ensures that businesses can continue to effectively manage their expenses, regardless of their size or industry.

Expense management plays a basic role in helping businesses streamline their operations, control costs, and keep up with monetary health. By giving enhanced visibility and control, increasing efficiency and accuracy, ensuring policy compliance and fraud prevention, identifying cost-saving opportunities, and offering scalability and flexibility, these systems empower businesses to effectively manage their expenses and drive long-term success. With the right expense management in place, businesses can optimize their spending, improve their main concern, and remain ahead in the present competitive marketplace.